Things about Stonewell Bookkeeping

Wiki Article

Stonewell Bookkeeping Fundamentals Explained

Table of ContentsThe 8-Minute Rule for Stonewell Bookkeeping7 Simple Techniques For Stonewell BookkeepingThe Stonewell Bookkeeping PDFsGet This Report about Stonewell BookkeepingAll About Stonewell Bookkeeping

Every company, from handcrafted cloth makers to video game designers to dining establishment chains, gains and spends money. You might not totally understand or also start to totally appreciate what a bookkeeper does.The background of bookkeeping dates back to the start of business, around 2600 B.C. Early Babylonian and Mesopotamian bookkeepers maintained documents on clay tablets to maintain accounts of purchases in remote cities. It consisted of a daily journal of every purchase in the chronological order.

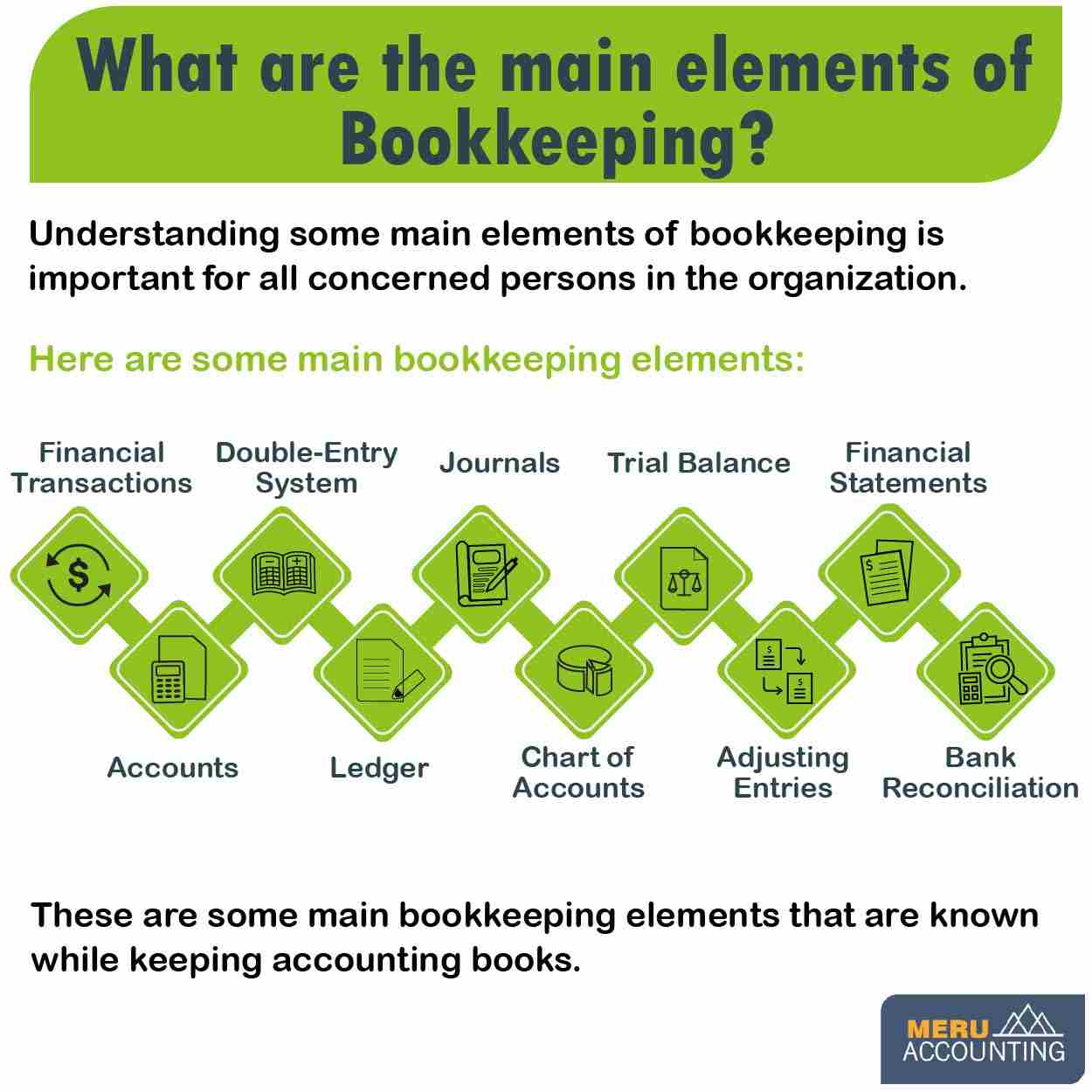

Small companies might rely only on an accountant in the beginning, yet as they grow, having both specialists on board ends up being significantly valuable. There are 2 main sorts of bookkeeping: single-entry and double-entry accounting. records one side of a monetary purchase, such as including $100 to your cost account when you make a $100 acquisition with your bank card.

The smart Trick of Stonewell Bookkeeping That Nobody is Discussing

While low-cost, it's time consuming and prone to errors - https://anotepad.com/notes/qmk5gfhb. These systems automatically sync with your credit report card networks to provide you credit history card transaction information in real-time, and automatically code all information around costs consisting of projects, GL codes, locations, and groups.Additionally, some accountants also help in optimizing payroll and invoice generation for an organization. An effective bookkeeper requires the complying with skills: Precision is vital in economic recordkeeping.

They normally start with a macro perspective, such as an annual report or an earnings and loss statement, and after that drill into the information. Bookkeepers ensure that supplier and consumer records are constantly up to date, even as people and services change. They might additionally require to coordinate with various other divisions to guarantee that everybody is utilizing the same information.

The Basic Principles Of Stonewell Bookkeeping

Bookkeepers quickly process inbound AP transactions promptly and see to it they are well-documented and easy to audit. Going into bills right into the bookkeeping system enables precise preparation and decision-making. Bookkeepers swiftly develop and send out invoices that are very easy to track and replicate. This aids companies get settlements much faster and enhance capital.This assists prevent discrepancies. Bookkeepers regularly conduct physical supply counts to stay clear of overemphasizing the value of assets. This is an essential facet that auditors carefully check out. Involve inner auditors and compare their counts with the recorded worths. Accountants can work as freelancers or internal staff members, and their settlement differs relying on the nature of their employment.

Freelancers commonly charge by the hour however may supply flat-rate plans for certain jobs., the average bookkeeper salary in the United States is. Remember that wages can vary depending on experience, education, place, and industry.

Freelancers commonly charge by the hour however may supply flat-rate plans for certain jobs., the average bookkeeper salary in the United States is. Remember that wages can vary depending on experience, education, place, and industry.The Basic Principles Of Stonewell Bookkeeping

Several of the most usual documents that companies should submit to the federal government includesTransaction details Financial statementsTax conformity reportsCash flow reportsIf your accounting is up to date all year, you can prevent a lots of stress throughout tax obligation season. business tax filing services. Perseverance and interest to detail are crucial to far better bookkeeping

Seasonality belongs of any kind of work in the globe. For bookkeepers, seasonality suggests durations when repayments come flying in through the roofing system, where having impressive work can come to be a severe blocker. It becomes essential to expect these minutes beforehand and to finish any kind of stockpile prior to the stress period hits.

The 10-Second Trick For Stonewell Bookkeeping

Preventing this will certainly lower the risk of setting off an internal revenue service audit as it provides an accurate representation of your funds. content Some typical to maintain your individual and company financial resources different areUsing a business credit history card for all your business expensesHaving separate monitoring accountsKeeping receipts for individual and organization expenses different Visualize a world where your accounting is done for you.These combinations are self-serve and require no coding. It can immediately import information such as workers, projects, classifications, GL codes, departments, job codes, price codes, tax obligations, and much more, while exporting costs as bills, journal entrances, or credit history card fees in real-time.

Consider the adhering to tips: A bookkeeper that has actually dealt with services in your industry will better understand your certain needs. Accreditations like those from AIPB or NACPB can be a sign of reputation and capability. Request recommendations or examine on-line reviews to ensure you're employing a person reliable. is a wonderful area to start.

Report this wiki page